The Ultimate Guide To 1031 Exchange Fund

Table of ContentsExamine This Report on 1031 Exchange Rules California 2022Indicators on California 1031 Exchange You Need To KnowThe Facts About 1031 Exchange Into A Fund RevealedLittle Known Questions About Tax Shelter Real Estate.The Main Principles Of 1031 Exchange Rules The Main Principles Of What Is 1031 Exchange California

Instance: You stop using your coastline residence, lease it out for 6 months or a year, and after that exchange it for an additional residential or commercial property. If you obtain a renter and conduct yourself in a businesslike means, then you've possibly transformed the residence to a financial investment residential or commercial property, which need to make your 1031 exchange all.

Relocating Into a 1031 Swap House If you wish to utilize the residential or commercial property for which you exchanged as your brand-new 2nd or even primary house, you can't relocate right away. In 2008, the IRS set forth a safe harbor guideline, under which it stated it would not challenge whether a substitute home certified as an investment home for functions of Section 1031 (capital gains taxes in california) - his comment is here.

Your personal use the dwelling system can not surpass the higher of 14 days or 10% of the variety of days during the 12-month period that the dwelling device is rented out at a fair service. After successfully switching one getaway or financial investment property for one more, you can not quickly convert the brand-new home to your main residence and take advantage of the $500,000 exemption.

The Buzz on 1031 Exchange

Currently, if you get property in a 1031 exchange and later attempt to offer that home as your principal home, the exemption will certainly not apply during the five-year period starting with the day when the residential property was acquired in the 1031 like-kind exchange (click). To put it simply, you'll need to wait a lot longer to make use of the primary home funding gains tax obligation break.

There is a means around this. They'll inherit the building at its stepped-up market-rate worth, as well.

In the type, you'll be asked to give descriptions of the buildings traded, the days when they were identified and transferred, any connection that you might have with the various other events with whom you exchanged buildings, and also the worth of the like-kind residential properties. You're also required to reveal the modified basis of the home surrendered and any kind of liabilities that you thought or removed.

The Only Guide for 1031 Exchange Into A Fund

If the IRS thinks that you haven't played by the policies, then you can be hit with a large tax bill and charges. 1031 exchange rules california 2022. Can You Do a 1031 Exchange on a Main House? Generally, a key house does not get approved for 1031 therapy due to the fact that you stay in that house and also do not hold it for investment functions.

1031 exchanges apply to real building held for investment purposes. Just how Do I Modification Possession of Replacement Building After a 1031 Exchange?

If you obtain rid of it swiftly, the Internal Income Service (IRS) might presume that you really did not get it with the objective of holding it for investment purposesthe fundamental regulation for 1031 exchanges. What is an Instance of a 1031 Exchange? Kim has an apartment or condo building that's presently worth $2 million, double what she spent for it seven years back.

Little Known Facts About Tax Shelter Real Estate.

5 million. By using the 1031 exchange, Kim could, theoretically, market her house building and also make use of the earnings to assist pay for the bigger substitute residential property without having to stress over the tax obligation obligation straightaway. She is effectively entrusted additional money to spend in the brand-new residential property by deferring funding gains as well as devaluation regain taxes.

Usually, when that building is eventually marketed, the IRS will wish to regain several of those reductions as well as element them right into the overall gross income. A 1031 can aid to delay that event by essentially rolling over the price basis from the old residential property to the new one that is replacing it.

The Bottom Line A 1031 exchange can be utilized by smart real estate financiers as a tax-deferred strategy to construct wide range. Nevertheless, the lots of intricate moving parts not just call for comprehending the rules yet likewise employing professional help even for skilled investors.

1031 Exchange Fund Can Be Fun For Everyone

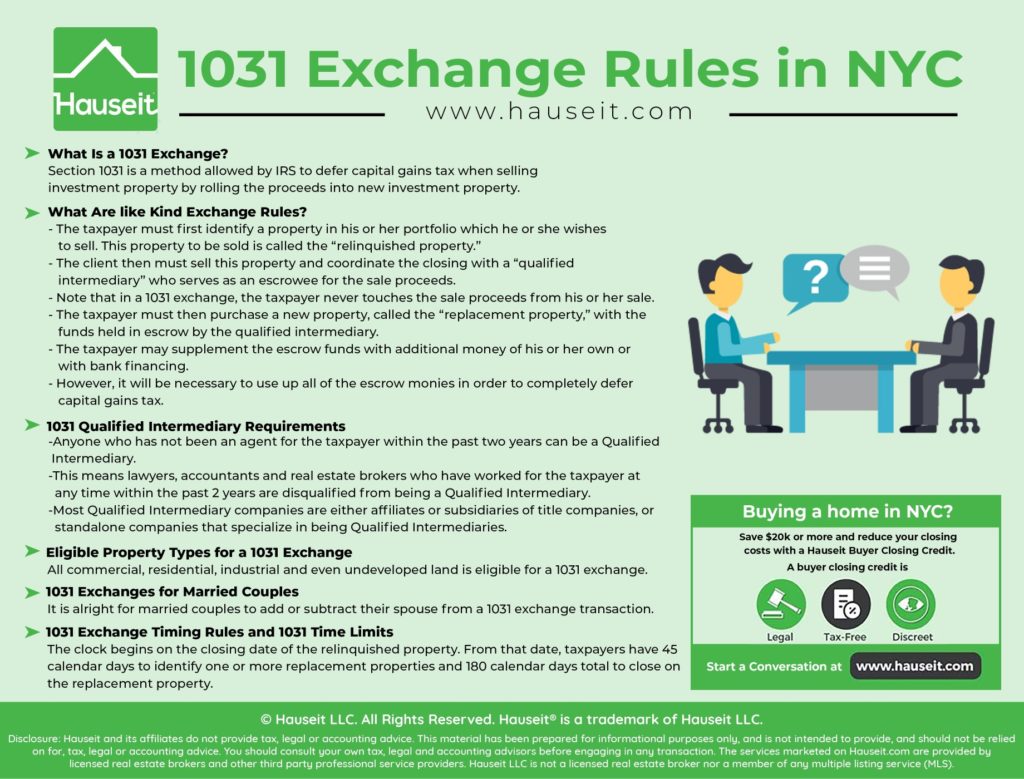

Savvy investor understand that a 1031 Exchange is a common tax technique that assists them to expand their portfolios and also increase net worth much faster as well as more effectively than would otherwise be feasible. So what is a 1031 Exchange, exactly how does it work, what are the various kinds and also how do you avoid common mistakes? Total the 6 actions below as well as you'll discover every little thing you need to learn about 1031 Exchanges.

# 1: Understand Exactly How the IRS Specifies a 1031 Exchange Under Section 1031 of the Internal Revenue Code like-kind exchanges are "when you trade real home made use of for business or held as redirected here a financial investment exclusively for other organization or investment building that coincides kind or 'like-kind'." This strategy has been allowed under the Internal Income Code considering that 1921, when Congress passed a law to stay clear of tax of ongoing investments in home and additionally to encourage active reinvestment.

# 2: Recognize Eligible Properties for a 1031 Exchange According to the Internal Profits Solution, building is like-kind if it's the exact same nature or character as the one being replaced, even if the top quality is different. The internal revenue service thinks about property home to be like-kind despite exactly how the real estate is improved.

What Does Tax Shelter Real Estate Do?

That consists of products such as equipment, devices, art work, collectibles, licenses and also intellectual home (read this article).